In a world where convenience drives customer decisions, offering a smooth and secure payment experience isn’t just nice to have – it’s a must. Whether you’re running an online store, a service-based business, or a physical shop with digital reach, the right tech matters. That’s why finding the best payment gateway for small business can play a huge role in shaping how customers interact with your brand – and whether they come back.

But with so many providers out there, how do you know which one is right for your business?

Let’s break it down.

What is a payment gateway?

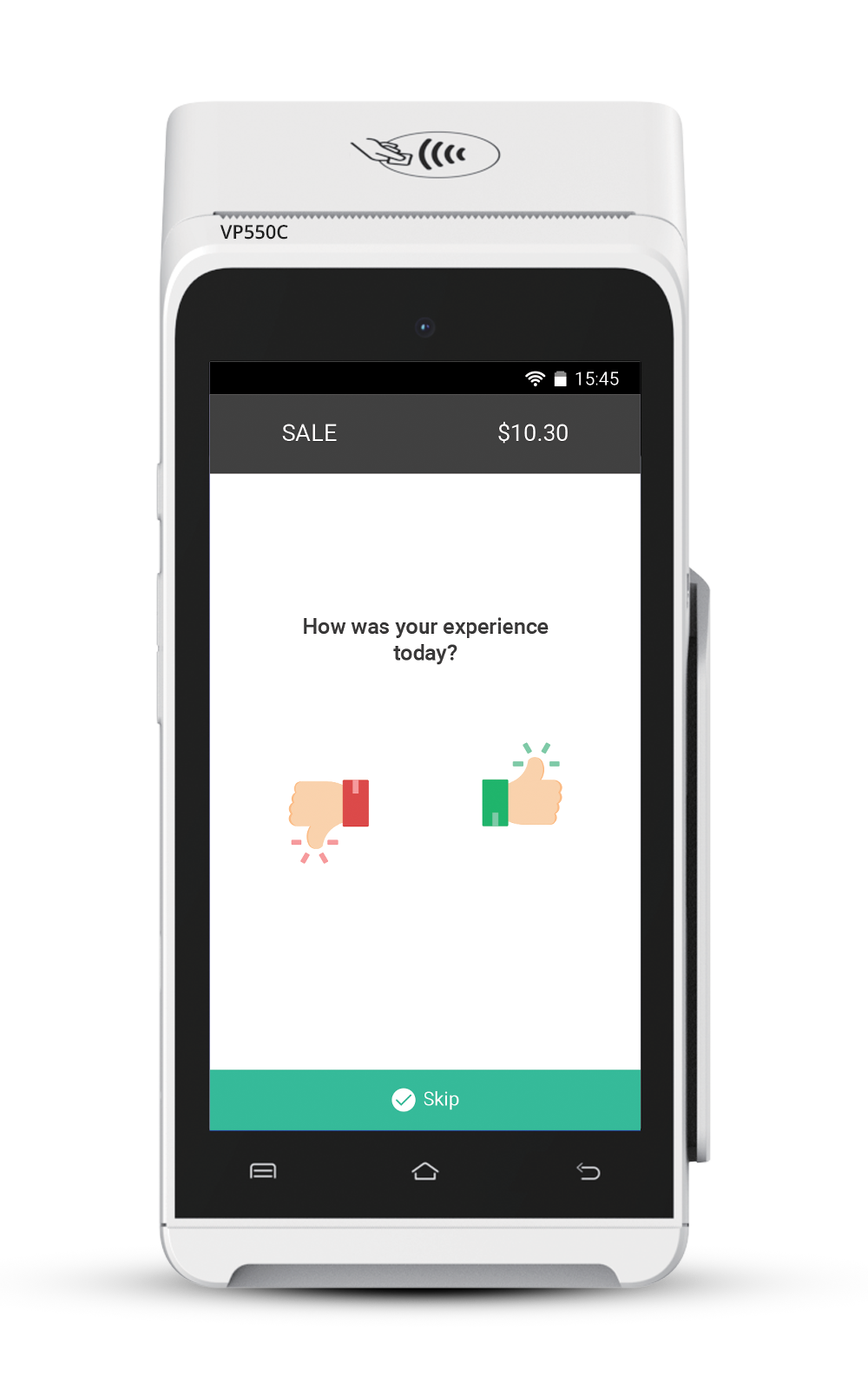

A payment gateway is the technology that securely captures and processes customer payment information. Think of it as the virtual version of a point-of-sale (POS) terminal, working behind the scenes to approve or decline transactions.

It connects your website or app to the payment processor and bank, ensuring a smooth flow of money between your customers and your business.

Why small businesses need a payment gateway?

Small businesses often operate with limited resources and tight margins. That makes it even more important to have reliable, secure, and cost-effective payment processing.

Here’s why a best payment gateway for small business matters:

- Builds trust: Customers are more likely to purchase from a site that offers secure and familiar payment options.

- Increases conversions: A fast, user-friendly checkout process reduces cart abandonment.

- Supports multiple payment methods: Credit cards, digital wallets, ACH, BNPL – customers want options.

- Helps you scale: With the right gateway, you can expand to new markets without changing your core setup.

Top features to look for in 2026

Not all gateways are created equal. In 2026, small businesses should be on the lookout for the following must-haves:

- Low transaction fees: Small businesses can’t afford to lose too much per sale. Look for competitive, transparent pricing models.

- Security & compliance: Ensure PCI-DSS compliance, end-to-end encryption, and fraud prevention tools.

- Multi-currency support: If you’re selling internationally, this is crucial.

- Mobile optimization: More users are buying via mobile – your gateway should be mobile-first.

- Customizable checkout: Tailor the experience to match your brand and customer journey.

- Fast settlements: Cash flow matters – check how quickly funds hit your account.

- 24/7 support: Issues don’t stick to business hours, and neither should your support team.

Best payment gateways for small businesses in USA (2026 edition)

Here’s a quick rundown of popular payment gateways in 2026, based on reliability, ease of use, and value:

1. Valor PayTech

Best for: Small businesses looking for a unified commerce experience

Pros: All-in-one platform, fast onboarding, user-friendly interface, strong customer support

Cons: Primarily available through authorized partners

Why it stands out: Valor PayTech offers a full suite of payment solutions – online, in-store, and mobile. With built-in features like real-time reporting, seamless integrations, and consistent user experience across channels, it’s built for businesses ready to scale without the tech headaches. Plus, its commitment to secure, PCI-compliant processing gives small businesses the peace of mind they need.

Many small businesses across major cities like New York are turning to Valor PayTech for its flexibility and easy onboarding.

2. Stripe

Best for: Online businesses and developers.

Pros: Highly customizable, scalable, and equipped with rich APIs.

Cons: May be complex for non-technical users.

3. Square

Best for: Businesses operating both online and in physical locations.

Pros: Integrated POS and payment gateway and user-friendly interface.

Cons: Limited customization options.

4. Authorize.Net

Best for: Traditional small businesses seeking reliable online payment processing.

Pros: Advanced fraud tools, solid customer support, and easy integration with numerous payment solutions.

Cons: Monthly fees and a complex fee structure.

5. Shopify Payments

Best for: Businesses already using the Shopify platform.

Pros: Seamless integration with Shopify stores and no additional transaction fees when used exclusively.

Cons: Limited to Shopify platform.

6. Adyen

Best for: Businesses aiming for international expansion.

Pros: Multi-currency support, enterprise-level reliability, and advanced data insights.

Cons: May have a higher barrier to entry for small businesses.

How to choose the best payment gateway for small business

The right payment gateway depends on your business setup, your customers, and how you operate day-to-day. There’s no one-size-fits-all – what works for one business might not work for another.

Every business is different, and so are your payment needs. Here are some key factors to consider:

Business model: Are you online-only, brick-and-mortar, or hybrid?

Target market: Domestic, international, or both?

Volume: Some gateways offer better rates for higher monthly sales.

Technical resources: Can your team handle advanced integrations?

Take the time to test out a few options. Many platforms offer demos, free trials, or even sandbox environments to experiment with before committing.

Integrating a best payment gateway for small business into your website or app

The good news? It’s easier than ever to add a payment gateway to your site or mobile app. Most providers offer:

- Plugins for platforms like Shopify, Valor Pay, WooCommerce, Magento, and Wix.

- APIs for custom development.

- Hosted payment pages if you don’t want to handle sensitive data directly.

You don’t need to be a developer to get started – but having someone on your team who understands the basics can help speed things up.

What you need to know about security and compliance

A best payment gateway for small business should handle sensitive data, which means security should be non-negotiable. As a small business owner, you should ensure:

- Your gateway is PCI DSS compliant.

- It uses tokenization and encryption.

- It offers fraud detection and prevention tools.

- It provides two-factor authentication for admin access.

Even if you’re not a security expert, your payment provider should be – and they should make it easy for you to stay compliant.

Trends in payment processing for small businesses (2026)

Staying ahead of payment trends gives your business a competitive edge. Here’s what’s shaping the payment landscape in 2026:

- Buy Now, Pay Later (BNPL): flexible payments continue to grow in popularity.

- Crypto-friendly gateways: some platforms are now allowing crypto payments.

- Embedded finance: more platforms are integrating banking features directly into payment flows.

- Ai-powered fraud detection: smart tools are catching more fraud attempts in real time.

- One-click checkout: Reducing friction with saved credentials and autofill.

If your gateway isn’t keeping up, it might be time to switch.

Final thoughts

Choosing the best payment gateway for small business isn’t just a tech decision – it’s a strategic one. The right partner can streamline operations, reduce costs, and even improve customer satisfaction.

So, take your time, weigh your options, and focus on what matters most to your business.

Because at the end of the day, it’s not just about collecting payments – it’s about powering growth.

Whether you’re based in New York or anywhere in the US, choosing the right payment gateway can transform how your business grows in 2026.

FAQ

1. What is the best payment gateway for small businesses in 2026?

The best payment gateway for small business in 2026 depends on your needs. Valor PayTech stands out for all-in-one features, while Stripe is great for developers, and Square works well for hybrid businesses.

2. Are there affordable options for small businesses just starting out?

Absolutely. Platforms like Square and Shopify Payments offer budget-friendly options with simple setup and low upfront costs, ideal for small businesses.

3. What security features should the best payment gateway for small business include?

Look for PCI DSS compliance, tokenization, end-to-end encryption, fraud detection, and two-factor authentication to keep customer data secure.

4. Can I switch my payment gateway later if I outgrow it?

Yes. Many platforms allow you to switch or upgrade. Just ensure your new gateway integrates with your existing systems and offers migration support.

5. How do I choose the best payment gateway for my small business?

Start by considering your business type, target market, and transaction volume. Look for low fees, strong security, mobile compatibility, and easy integration.

6. Can I integrate into a payment gateway without having a website?

Yes! You don’t need a website to start accepting payments. Many providers offer alternatives like POS terminals for in-store use, mobile apps for on-the-go payments, and even payment links. It’s all about choosing a setup that matches your business.

7. Which payment gateways support both online and in-store transactions?

If you’re running a hybrid setup, you’ll want a gateway that covers both bases. Options like Square, Valor PayTech, and Shopify Payments let you manage payments across physical and digital channels with one unified system.

8. Can I accept international payments using these gateways?

Most modern gateways offer international capabilities, but features can vary. Adyen, Stripe, and Valor PayTech support multi-currency transactions and global compliance, making them great picks if you’re planning to sell beyond borders.

Ready to get started?

Become a Partner Today!

Complete the form below.